A totem for partnership – the art and craft of the Collective Impact Bond

Sam Magne, Knowledge & Learning Manager at The National Lottery Community Fund, reflects on their latest in-depth review of the West London Zone Collective Bond (CIB) supported by their Commissioning Better Outcomes programme (CBO). She explains why the CIB is an intriguing case study for those who want to design a partnership in which the driving goal is one of building the motivating and operating conditions for gathering parties to work together and garner resources collectively around people whose lives will not change for the better without more systemic coordination.

50 shades of SIBness

A dry-witted speaker at a GO Lab conference once commented that there was no one such thing as a SIB (or Social Impact Bond) – only 50 shades of SIBness. In the CBO evaluation conducted by Ecorys and ATQ, we place the spotlight on a number of variations on the SIBness theme which, at its core, is focused on deploying capital to enable interventions to pursue outcomes - until such time as they can prove their impact and claim payment from commissioners.

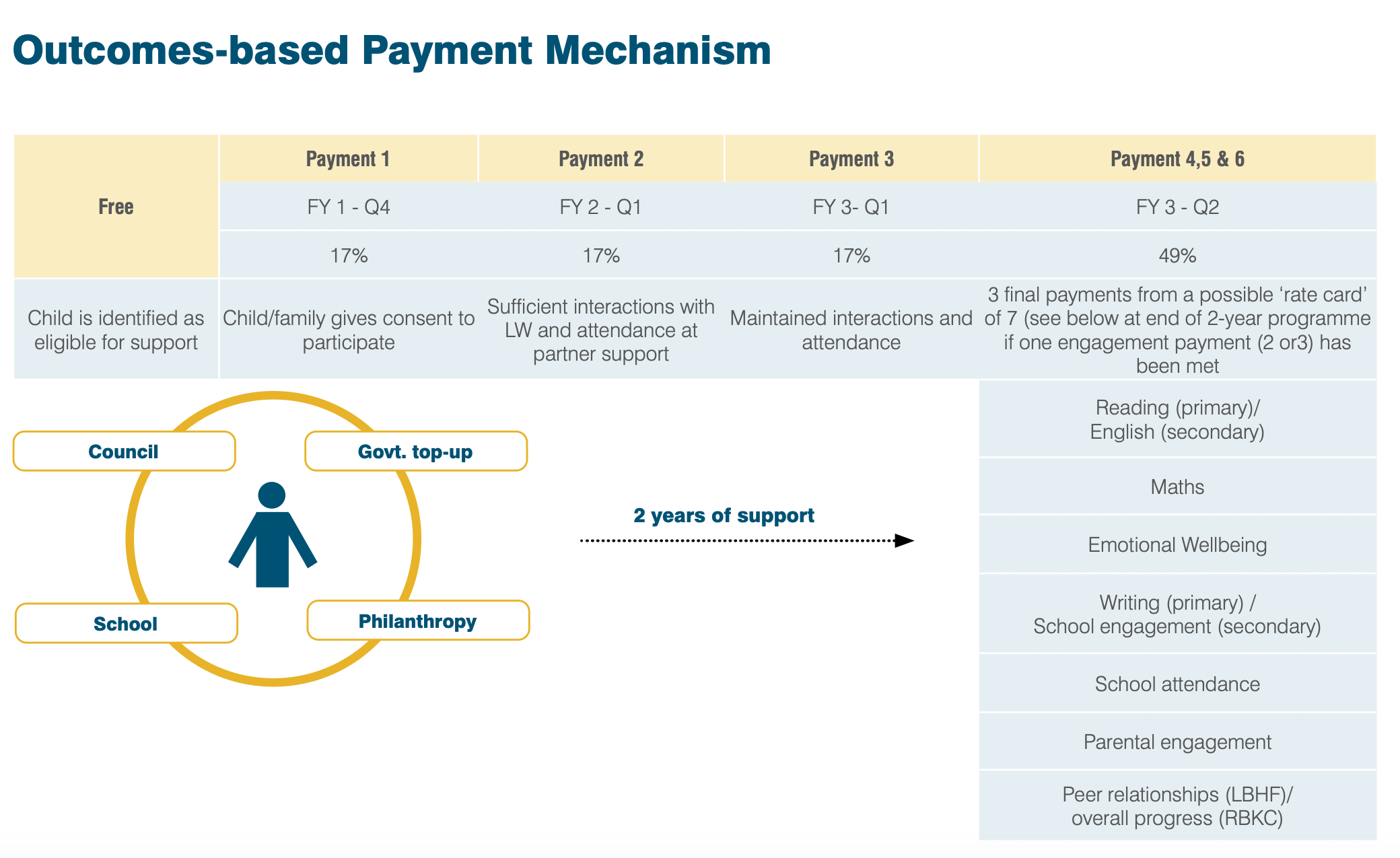

One of these variations is the concept of a Collective Impact Bond, a term coined by the West London Zone (WLZ) initiative. The CIB’s approach to designing the triggers on its rate-card which verify and buy support for its impact adds intriguing colour to the SIB spectrum. Our evaluation’s second visit to WLZ brings this sophisticated art and craft of the CIB concept to the surface.

The name’s Bond

Observers have long made the point that a SIB is not a ‘bond’ in the conventional financing sense. I’d argue that the concept of a CIB moves the notion of a ‘bond’ artfully away from the financial definition, to centre it instead on the social process of creating a ‘bond’ - in which parties are brought together around a common interest. In this clever pivot, the finance that’s deployed to support WLZ until outcomes are paid is not the ‘B’ in the CIB; instead, the co-design approach to setting the rate card (which the finance then underpins), is.

Reflecting on WLZ’s approach to developing their rate card, my minds-eye conjures the metaphoric image of a collaborative community art project, in which WLZ is creatively mustering disparate groups together to produce a totem pole.

WLZ has used the process of deciding which hopes, concerns, goals and markers of progress are depicted on its totemic rate-card to bring together a diverse set of stakeholders. This includes not only a network of VCSE organisations and schools as its delivery partners, but also the varied interests of public bodies, schools, grant makers, small local givers and high-net-worth philanthropists as its commissioners.

A rate card is conventionally used in outcomes-based commissioning to mark out a set of outcomes that will be paid for, their price, and how it will be established that any outcomes achieved can be attributed to the commissioned intervention. In practice, many SIBs – as well as other forms of commissioning seeking impact evaluation - face real challenges when it comes to establishing a counterfactual for factoring in the ‘deadweight’ of outcomes that would have occurred anyway. The challenges can arise from the costs or ethics of setting up both a control and a treatment group or, the lack of available, relevant population datasets for setting benchmarks or, from the heterogeneity of the cohort. In the US it is common to take a gold standard approach to establishing the counterfactual element of a payment trigger in SIBs; US SIBs often have a focus on experimental innovations which drives this (which perhaps partly explains why there are far fewer SIBs there). By contrast, the approach to counterfactual design in locally commissioned UK SIBs (where most of the world’s current tally of 204 SIBs are) is more varied.

The secret sauce in addressing the challenges of attribution

In the case of WLZ, the totemic rate-card’s primary function is to bring people together around a shared definition of what matters and how to get there. This, it seems, is its secret sauce in addressing the challenges of attribution. What’s intriguing is the WLZ partners’ pragmatism around testing the counterfactual of the totem’s markers,. Having chosen the areas of progress that matter to them in serving a carefully defined but multi-faceted cohort and then, having hit limits to the availability of data with which to discount outcomes that would have occurred anyway, they’ve settled on agreeing forms of benchmarking that provide good enough confidence for all parties. The rate-card has a menu-like design in which evidence of meaningful and sustained engagement in the programme is a pre-condition for triggering payment on other progress measures – as relevant to each child. Some items on the menu are accompanied by robust national counterfactual data, and softer items rely on individual progress. In other words, they’ve taken the totem’s markers as far as they agree they can reasonably go.

Looking to the future

WLZ is an early-action initiative, seeking far-reaching impacts for children in their later lives; and these are even trickier to test. But undaunted, and after much searching, WLZ has recently commissioned an impact evaluation. This will inform its future work and help to hone the shared definition of nearer-term proxies that are indicative of WLZ’s long-term impact goals.

In the meantime, the job of the CIB rate-card is to keep the collective effort around children’s life-chances vibrant. Its art is to muster champions, build consensus, align interests, create the motivational drivers and insert the magic of ‘just enough’ conditionality and counterfactual to sustain the confidence that attracts its resource and collaborative commitment. The job of its risk-sharing capital is not to be the ‘bond’, but to underwrite it and allow it freedom to develop.

Interested in reading the in-depth review?

The third and final CBO evaluation visit to WLZ will look at how this totemic CIB arrangement holds up for WLZ. The signs that it’ll keep the partnership on board, as Ecorys report in the meantime, look good: "WLZ has made a number of operational and management changes in their first two years of delivery. This suggests that they were effectively monitoring their own performance, holding themselves to account, and then acting quickly to ensure that performance remains on track; our SIB research has found that this type of adaptive management is common in SIBs but is more typically driven by the social investor, often mediated through external intermediary support. And yet accounts by both WLZ and Bridges [WLZ’s investment fund manager] suggest that, in the case of WLZ, this approach was driven by the motivations of WLZ itself to achieve - and evidence - greater impact for at-risk young people."

Samantha Magne

Samantha Magne