An innovative model for using social investment to drive financial inclusion in Israel

Posted:

15 Jun 2022, 4:58 p.m.

Author:

-

Michael P. Lustig

Adjunct Professor, NYU | Stern School of Business

Michael P. Lustig

Adjunct Professor, NYU | Stern School of Business

Topics:

Social impact investing

For those on the periphery of the banking system, accessing lending can be challenging. If it is available at all, it is generally accompanied by high interest rates and other demanding guarantee requirements. In this blog, Michael P. Lustig – Adjunct Professor of Finance at the NYU Stern School of Business, and board member of the American Friends of Ogen – explains how an Israeli social bank has used innovative models to fill the gap and support those who are underserved by the country’s traditional finance system.

For those on the periphery of the banking system, accessing lending can be challenging. If it is available at all, it is generally accompanied by high interest rates and other demanding guarantee requirements. In this blog, Michael P. Lustig – Adjunct Professor of Finance at the NYU Stern School of Business, and board member of the American Friends of Ogen – explains how an Israeli social bank has used innovative models to fill the gap and support those who are underserved by the country’s traditional finance system.

Financial exclusion in Israel

Some countries have successfully used legislative means to increase access to finance for communities that are often excluded from traditional bank lending, as companies in those places are seen as too risky or economically immature. For example, the UK and US passed acts that created Community Development Finance Institutions (CDFIs). The State of Israel lacks that official approach, but that hasn’t stopped a local NGO from transforming itself into the country’s first “social bank”, and financing that change in a variety of innovative ways.

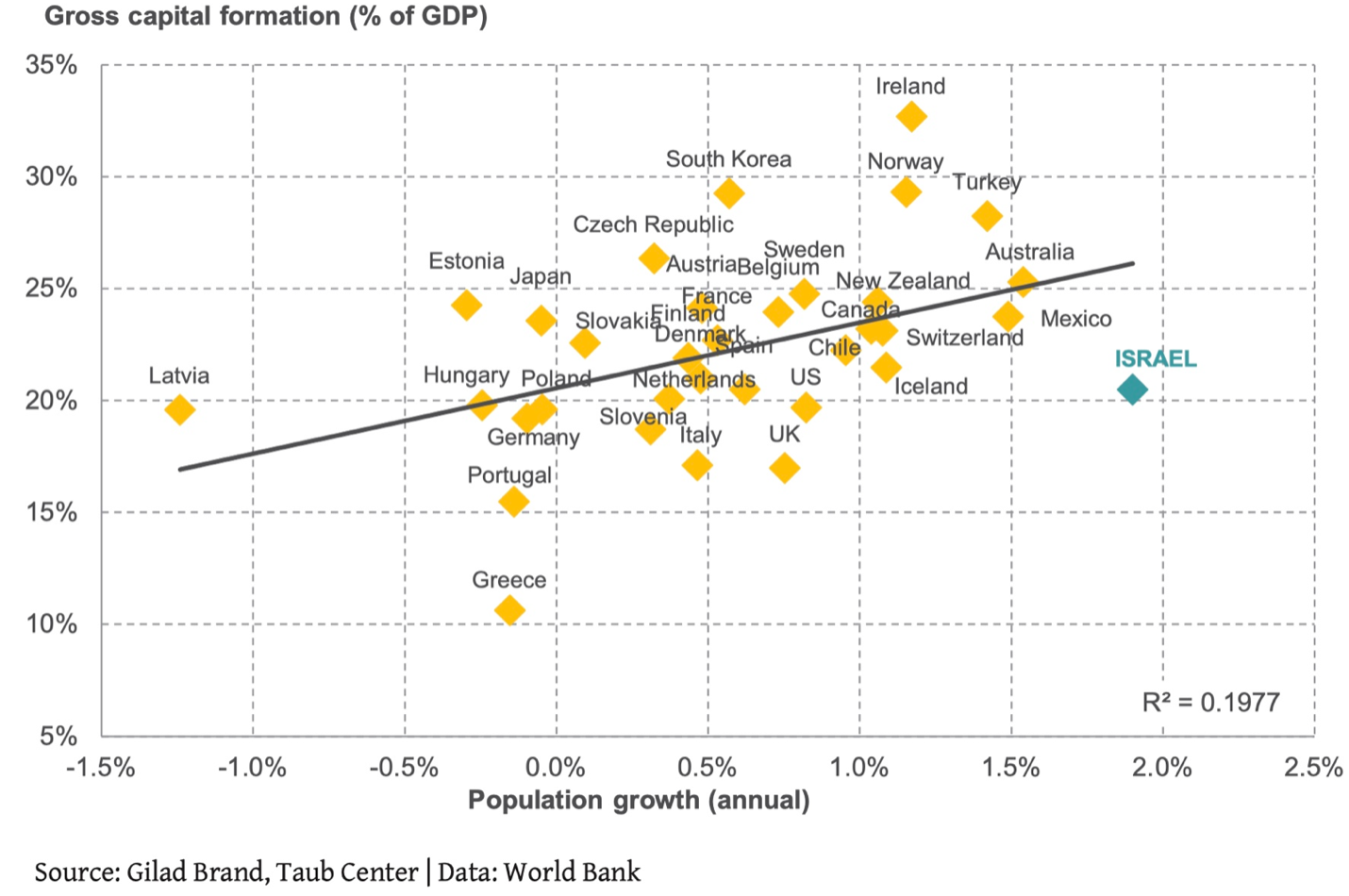

The Israeli banking system is an oligopoly, with five bank holding companies controlling over 90% of the assets & credit in the system. The institutions tend to be geared towards the affluent, and focus on providing credit and services to that segment of the population; when credit is indeed extended to those on the social or economic periphery, loans are usually only made at higher interest rates and preconditioned on the borrower assembling onerous personal guarantees. In addition to effectively excluding a large segment of society from access to credit, this also has an impact on the country’s economic health, particularly given the growth of the population. As the figure shows, investments in the Israeli Economy (measured by “gross capital formation”) have not kept pace with the growth in population:

A developing “social bank”

The Ogen Group (formerly the Israel Free Loan Association, or IFLA) has expanded beyond its longstanding free-lending platform, which was dependent on philanthropic donations and is therefore inherently limited in size and scope. The organization has obtained a credit license from the Israeli Capital Markets Authority (part of the Ministry of Finance) to start a “social bank”, becoming the first non-profit financial institution in the country. Ogen subsequently introduced affordable-interest lending options (ranging from 1.5% to 4.5% over the Prime Rate) in larger-sized loans up to ₪650k (approx. USD200k). As a result, the platform has greatly increased the number of loans made over the last few years as it broadened its mandate away from small/interest-free lending, from ₪67m (approx. USD21m) in 2019 to over ₪200m (approx. USD62m) in 2021.

Having established a scalable infrastructure to make loans, the Jerusalem-based lender operates all around the country, focusing on extending credit in Israel’s socioeconomic periphery regions. Ogen’s new, low-interest loans have been used to help start small businesses, expand existing businesses, fund investments in inventory, and purchase equipment. Ogen also extends credit to NGOs, which have also had more difficulty in borrowing from traditional banks.

Given that Ogen doesn’t have the full status of a banking institution, it is limited (on a regulatory basis) to a maximum of 29 depositors. Not surprisingly, that constraint invites creativity when it comes to raising capital to finance their lending, which was originally expressed through a novel form of financing: impact loans. Each deposit was structured as a 5-year loan bearing a 1% interest rate, with a minimum size of USD1m (the impact investors for this product are predominantly from the U.S.). The sourcing of these impact loans has been very successful, currently totaling USD13m from 11 investors; this funding has provided the lifeblood for the increase in Ogen’s lending volume over the last two years.

The Credit Inclusion Bond

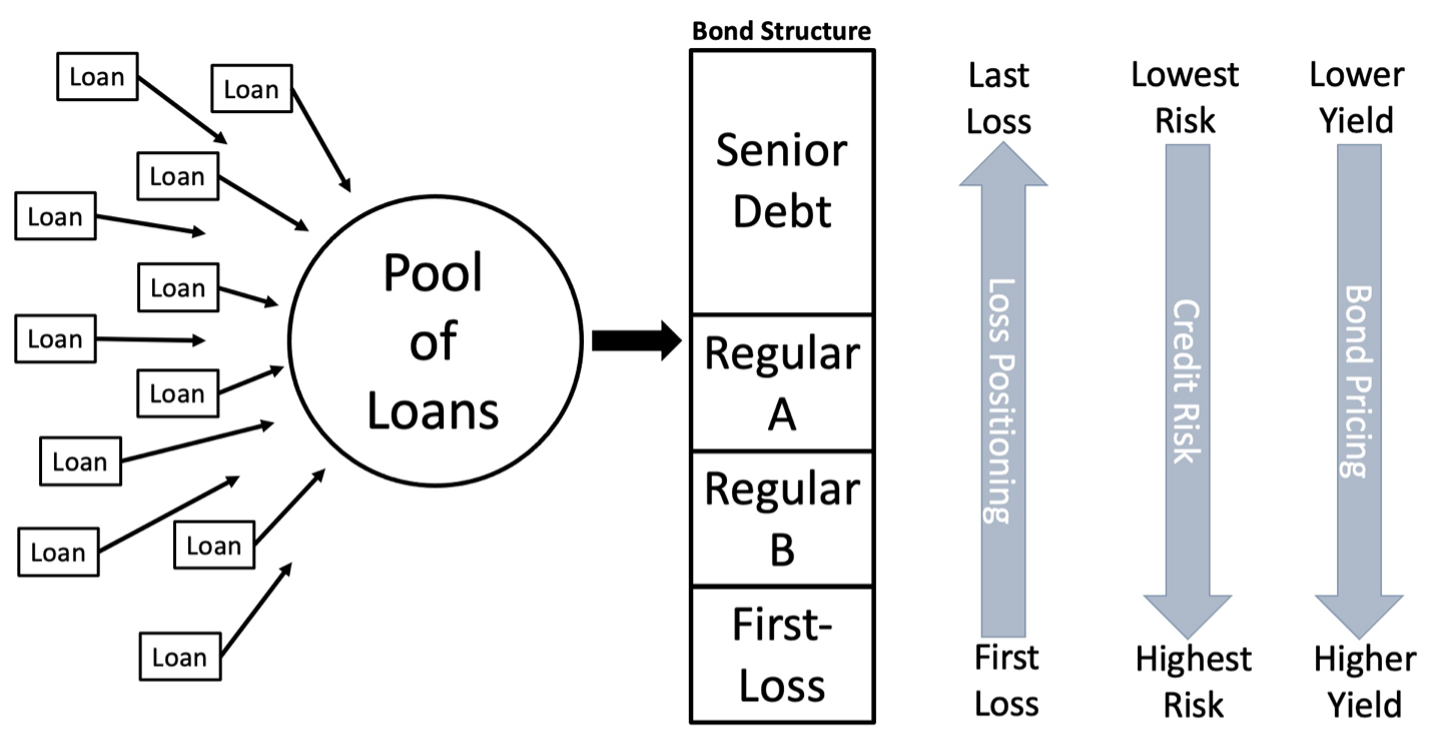

Recently, Ogen has financed its lending through another innovative approach: a tranched, securitized financing, the “Credit Inclusion Bond”. Essentially, ₪50m (USD15m) of existing loans were placed in a trust, and bonds were created out of that trust with varying degrees of cashflow/loss priority. The underlying loans have a diversity of purpose and geography, to avoid risk concentrations. The first-loss piece has the lowest priority on the cashflow of the deal (absorbing the first 15% of realized losses), and it has been retained by Ogen, while the remaining three bonds were sold to a variety of institutional investors.

| Tranche | Balance | Coupon (interest rate) | Default Coverage | Interest paid | Modified duration | |

|---|---|---|---|---|---|---|

| Senior Debt | ₪25.0MM | 1.15% | 50-100% | Quarterly | 1.4 | |

| Regular A | ₪12.5MM | 1.8% | 25-50% | Quarterly | 3.4 | |

| Regular B | ₪5.0MM | 2.8% | 15-25% | Quarterly | 4.2 | |

| First-Loss | ₪7.5MM | 0.0% | 0-15% | - | - | |

| Total | 1.31% |

It’s worth noting that the international convention is for a 5% first-loss piece, while the Israel Capital Markets Authority has mandated a 10% minimum; here Ogen has opted for extra conservatism with a 15% first-loss. IFLA, the predecessor organization of Ogen, experienced an impressive 0.7% loss rate over its 30-year existence, but the expectation is that the newly-created loans, with larger balances and wider purposes, may experience somewhat greater losses – hence the conservative credit cushion.

Structured bonds redistribute cashflow-priority and loss-risk, and the Ogen Credit Inclusion Bond conforms to this standard/tranched model. There are three bonds senior to the first-loss, and cashflows are prioritized from the top-down, while losses impact from the bottom-up. In practice, this means that the pool must experience cumulative losses of over 15% before any principal is at risk for the ‘Regular B’ bond, and over 25% before impacting the ‘Regular A’ bond, etc. While these types of losses are certainly not within the realm of current expectations, the bonds bear interest rates (coupons) which reflect the increased default risk. Conversely, as principal is paid-down across the underlying pool of loans, that cashflow is prioritized to the ‘Senior Debt’ bond until it is fully paid-down, after which time the ‘Regular A’ bond is prioritized, etc.

As noted in its name (“Bond I”), this is but the first of these bond structures planned. Given that this was the first bond of its type created in Israel, it was essentially a proof-of-concept; the bond has proven to be a success, and a similar (but larger!) structure is currently in the works!

The Ogen Group has expanded from its humbler beginnings of providing smaller interest-free loans (as IFLA) to what is now a robust stable of lending options, consultative services for personal financial planning, addressing the financial needs of NGOs, and a crowdfunding-lending platform to allow impact investors to direct small lending in a quasi-philanthropic (zero interest) manner. The Ogen Group will continue to grow and innovate to achieve its mission of addressing those who are underserved by the existing financial system in Israel.