The Art of Outcomes Rate Cards

Posted:

12 Mar 2024, 4:49 p.m.

Author:

-

Tiphanie Au

Head of Impact, International Centre for Missing and Exploited Children (ICMEC) Australia

Tiphanie Au

Head of Impact, International Centre for Missing and Exploited Children (ICMEC) Australia

Topics:

Impact bonds, Outcomes-based approaches, Social impact investing

For over seven years, Tiphanie Au oversaw the end-to-end development and implementation of outcomes-based contracting work across a range of government policy areas in the Australian State of New South Wales (NSW). This included contributing to the launch of Australia’s first rate card in 2018, where Tiphanie then led its evolution until late 2022 as the Associate Director of the NSW Government’s Office of Social Impact Investment. In this first part of a two-part blog series, Tiphanie shares her personal reflections and generalised insights into the Australian outcomes rate card experience.

For over seven years, Tiphanie Au oversaw the end-to-end development and implementation of outcomes-based contracting work across a range of government policy areas in the Australian State of New South Wales (NSW). This included contributing to the launch of Australia’s first rate card in 2018, where Tiphanie then led its evolution until late 2022 as the Associate Director of the NSW Government’s Office of Social Impact Investment. In this first part of a two-part blog series, Tiphanie shares her personal reflections and generalised insights into the Australian outcomes rate card experience.

What are outcomes rate cards?

As defined by GO Lab, an outcomes ‘rate card’ is a schedule of payments for specific outcomes a commissioner (outcome payer) is willing to make for each participant, cohort or specified improvement that verifiably achieves each outcome.

It is an approach first developed by the UK Department of Work and Pensions in 2011 and introduced in Australia by the New South Wales (NSW) Government’s Office of Social Impact Investment in 2018. While the focus of this article is on government-developed rate cards, rate cards can also be utilised by non-government parties. See, for example, an Australian example where a group of work-integrated social enterprises shaped a rate card together to inform a collective approach in negotiating payment-by-outcomes approaches with a relevant government agency.

A Tale of Two Artefacts for untested programs

Effective rate cards should ideally transcend the initiating commissioning process and carry through to program implementation (with some refinements). That may not always be feasible if the aim of the commissioning process is to seek innovative social impact investment (SII) proposals to disrupt the usual way things are done. This is because innovation that is untested in the local setting inevitably entails uncertainties.

These uncertainties encompass the complex interplay of the programme operations in practice that are often untested, including client referrals and ability to capture the required evidence to verify the outcomes achieved. These can be hard to quantify and capture by initial data analytics alone when designing rate cards.

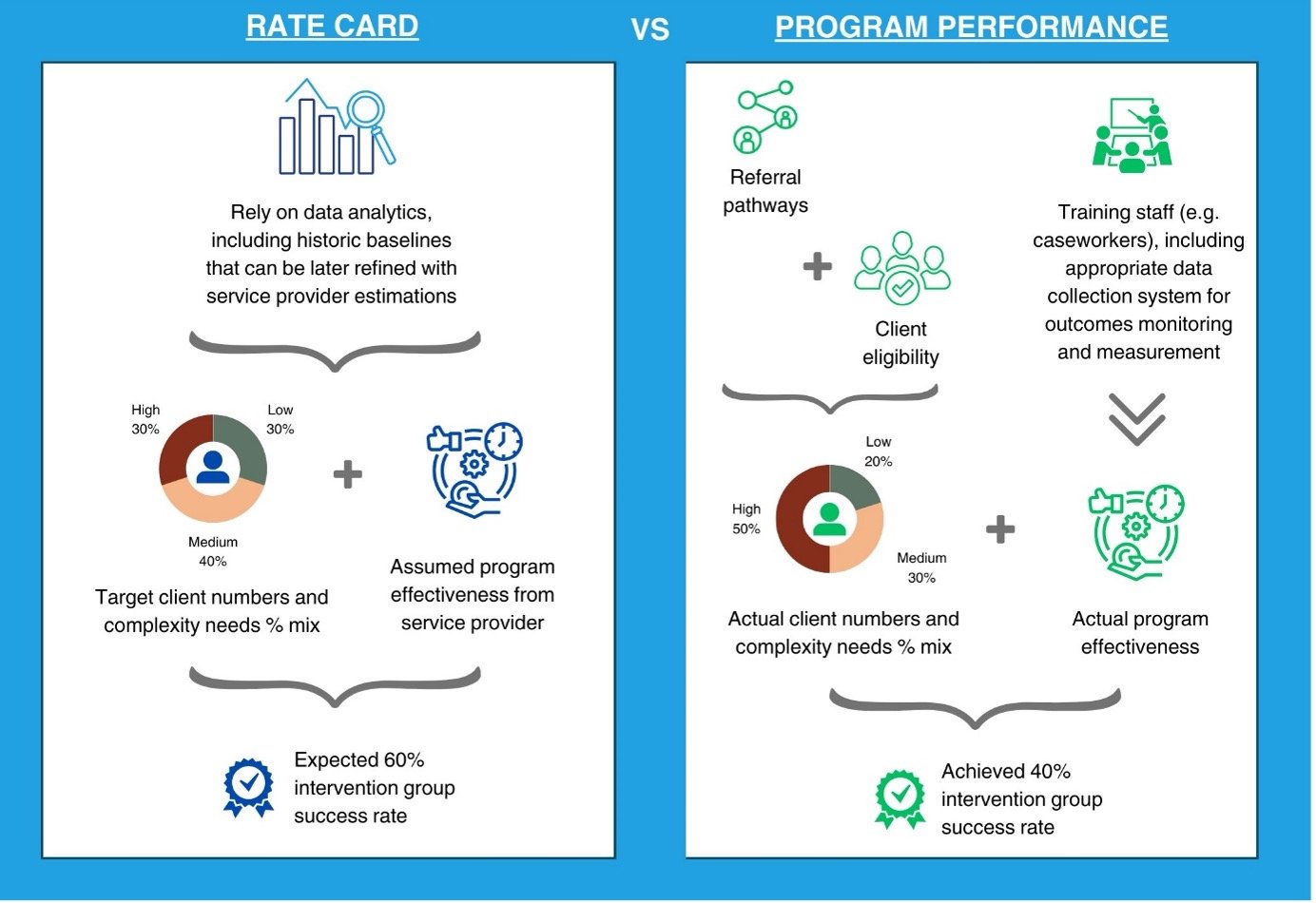

Below is an illustrative example of the risk of disconnect between the assumptions used to estimate the behaviour of the target cohort under the rate card compared to what is being observed with the actual target cohort.

In this illustrative example, a higher level of client complexity than expected may be referred into the programme and/or the ability of the service provider to support these clients and verify the outcomes achieved may turn out to be overly ambitious. A combination of these reasons could be contributing factors as to why a lower-than-expected number of the desired outcomes were achieved, compared to what was expected under the rate card.

In pursuit of incremental sector readiness towards outcomes-based commissioning

The above illustrative example presented an interesting challenge, that uncertainties associated with innovation could be challenging for rate cards. A commissioning scenario where uncertainties can be somewhat ameliorated is transitioning an existing grant program for a portfolio of the strongest performing service providers into a SII. Such transition process typically involves a careful change management process for service providers, who may only be accustomed to traditional payment structures based on inputs or activities. Rate cards can assist with this transition process by providing greater clarity and certainty for service providers in bridging the gap between traditional grants and outcomes-based commissioning.

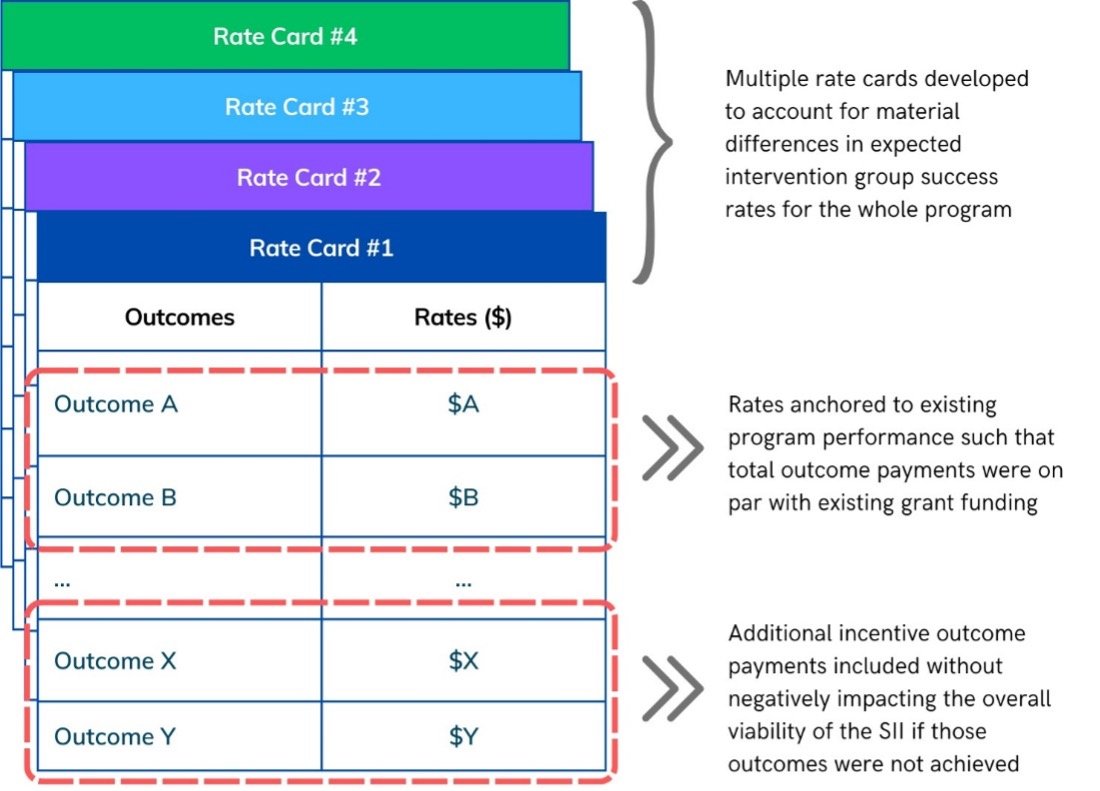

Under this scenario, performance data from the existing grant program can be leveraged to better understand the drivers behind any material differences in expected intervention group success rates among the portfolio of service providers. The availability of linked government administrative data can further enhance the robustness of the data analytics. The identified differences in expected intervention group success rates may be driven by factors such as service locations, market conditions, cohort complexity segmentations, etc. Developing multiple rate cards to clarify these differences can be helpful.

Noting the careful change management required under this transition scenario, a ‘SII-Lite’ approach can be adopted to provide additional certainty in the SII financials. This may be in the form of adjusting the individual rates in the rate cards such that the total outcome payments under expected performance matched the existing grant funding, thereby providing a financial safety net for service providers during the transition. Additional incentive payments can also be included in the rate cards as ‘stretch goals’ for service providers wishing to be more ambitious in achieving a greater breadth of outcomes.

As most programme uncertainties would have been tested under the existing grant programme, there should be greater confidence in the assumptions behind the multiple rate cards developed. Together with the incentive payment structure under the SII-Lite approach, and the fact that only the strongest performing service providers would be invited to continue the program as an SII, the overall financial viability of the SII would be strengthened. This would facilitate a more palatable transition process for all parties involved. Such a transition scenario presents a compelling opportunity to use rate cards as the vehicle in helping lay the groundwork for others in the sector to be more willing to experiment, and eventually adopt outcomes-based commissioning at scale.

In part 2 of this blog series, Tiphanie will outline the key ingredients that she has observed as being critical in developing effective rate cards.